It’s just a matter of time – the legacy banks will start losing revenue if they don’t re-imagine themselves

In India, the banking sector has undergone a drastic transformation in the last few years. But it won’t stop here, even greater disruptions are ahead.

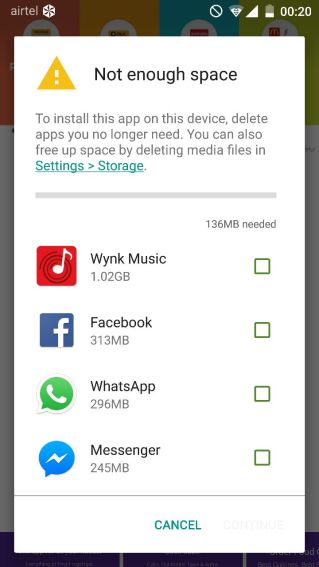

The shift towards digital is being fueled by the changing demographics in India – by 2020, the average age of a banking customer in India will be 29 years. This young consumer base, that has grown up with smartphones, is internet savvy, expects everything in real time and will demand more from the Indian banking sector. And India already has the 2nd largest smartphone user base in the world, which is expected to grow to 750M by 2020.

The banks have, for far too long, relied on their physical reach through branches. But with the ongoing digital revolution and changing customer preferences, the dynamics will change soon. Seamless experiences, personalized banking and customer centricity will become the key to acquiring and retaining customers.

The introduction and evolution of the infrastructure created by the government – India Stack (Aadhaar authentication, eKYC, DigiLocker, UPI, eSign etc.) will ironically make it easier for innovative tech companies to disrupt in months, what would have taken them years to do earlier. While this may not lead to large banks losing business immediately, the pie will have more takers and companies which are able to provide the best customer experience will win in the long run.

We don’t have to look far to realize the disruptions created by technology. Uber, the largest cab company in the world, was created amid rising smartphone adoption by innovative use of GPS, maps and data (their building blocks) all of which were accessible by anyone to build a similar company. OTT messaging apps like WhatsApp have more or less replaced texting (SMS) in the last 4-5yrs. Going from a drizzle to a storm can be a matter of a few quarters (maybe 10-12) in this digital age.

This pace of change is unusual for a regulated industry. Here are some reasons why it is crucial for banks to handle it well:

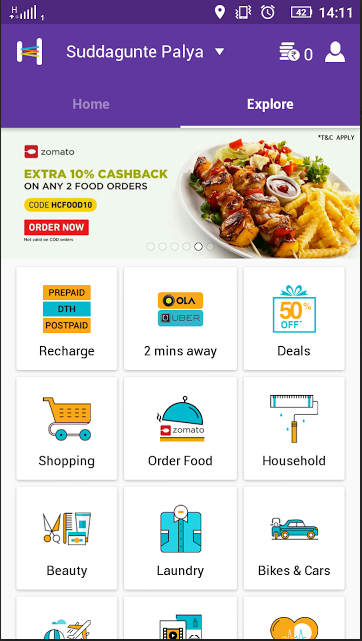

1. Their competition isn’t with other banks: The banking customer today is being wooed by the richest men in top 4 economies of the world – USA (Jeff Bezos – Amazon Pay), China (Jack Ma – PayTM), India (Mukesh Ambani – Jio Money), and Japan (Masayoshi Son – Flipkart/PhonePe). This is without counting Mark Zuckerberg, whose WhatsApp is likely to launch P2P payments, further intermediating the relationship between customers and their banks. Such players will create innovative products, reimagined for the digital customer. Banks will be competing against these super rich entrepreneurs and their highly agile, user experience (UX) focused consumer internet companies, rather than just other banks or telcos.

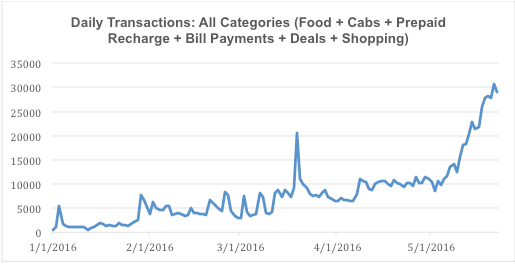

2. Trust alone cannot save the banks: Banking industry veterans feel that trust is a commodity that’s scarce – and that is correct. However, these new competitors will build trust with the younger Indians through reliability, branding, discounts and high repeat behaviour. It is very likely that in a few years, a few consumer mobile apps will hold inordinate control over the banking customer.

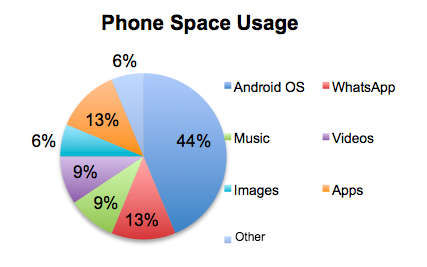

3. The machines are coming: The future will belong to sophisticated artificial intelligence models that require a lot of data. Data will become more difficult to get as it gets used better (e.g. Android permissions will become stricter). So unless the user is engaging with you on your mobile app, it will be difficult to capture useful data (which will enable some apps to build much better micro lending models than others). Whoever engages frequently with the customers, develops the strongest relationships and really knows their customers, will win the war of algorithms.

In a nutshell, the challenge is: can banks become platforms before platforms become banks?

A McKinsey & Company report estimates that banks which do not digitize more fully within the next 3-5 years, could see up to 35% of their net profits eroded. In China, Ant Financial (AliPay) and WeChat are already posing a significant threat to banks and financial service providers. A cursory visit to China is sufficient to know that the things have changed on the ground – people are paying for a lot of things using these two apps. Both have risen very quickly and processed US$2.9 trillion in payments in 2016 compared to just US$81.6 Bn in 2012.2 Both Alibaba (AliPay) and Tencent (WeChat) have now launched their own “Internet Banks” – MyBank and WeBank to start collecting deposits directly from customers and providing personal, corporate and international banking services.

In Europe, on the other hand, a majority of the traditional banks have won by partnering or co-opting fin-tech start-ups. BBVA, a multinational Spanish banking group, was one of the first to recognize the technological disruption headed their way. Way back in 2013, their Chairman Francisco González explained, “Some bankers and analysts think that Google, Facebook, Amazon or the like will not fully enter a highly regulated, low-margin business such as banking. I disagree. What is more, I think banks that are not prepared for such new competitors face certain death.” BBVA has been on an acquisition spree lately and has successfully acquired few good startups in the last couple of years.

Given the current situation in India, banks need to take a myriad of proactive steps:

- Start benchmarking against consumer internet companies not just in terms of customer experience but long term outlook and corresponding investments. Otherwise, it might end up being a classic study of the kind of disruption described by Clayton Christensen. Too much focus on NIM (net interest margins), QoQ growth and analyst expectations can be harmful if it happens at the expense of the future. It’s a great opportunity for an entrepreneurial bank CEO.

- Develop separate teams / companies / subsidiaries which have a separate culture and run their digital banks / other initiatives from the ground up without any legacy issues – software, or human.

- Start making big bets on tech start-ups. If they wish to compete with likes of Paytm, Jio and other consumer internet companies, they need to either buyout or invest into agile tech startups. This would not only give them a winning product but also bring in an energetic young team into their fold, which otherwise would not have worked for a bank.

- Ensure that the role of the Chief Digital Officer and the CTO/CIO is given sufficient leeway and they are supported over multiple year strategy roadmaps rather than be judged quickly

- Start creating models which leverage data to personalize products for their customers

In the above light, Axis Bank’s recent acquisition of Freecharge for US$60M and Bajaj Finance’s US$35M investment into Mobikwik for a ~10% stake makes a lot of sense. This would help them both grow fast inorganically and give them an edge on product innovation.

However, most banks are not doing enough. Perhaps the time to act is now. Such periods of chaos should be viewed as a ladder, not a pit.

Ankur Singla is the founder and CEO of Tapzo, India’s first all in one app backed by Sequoia Capital. He is a graduate of National Law School, Bangalore.

———————

A version of this article appeared in the Economic Times on 2 September 2017.

Sources: IAMAI-IMRB report, UN report, McKinsey & Company report

Image Credit: https://www.timeshighereducation.com/sites/default/files

/styles/the_breaking_news_image_style/public/Pictures/web/o/d/r/city_under_siege